Activity in the land market was strong over the traditionally quiet summer months, with demand for smaller sites, under 150 units, attracting the most interest according to a new report by real estate advisor Savills.

More new sites are coming to market increasing the supply of land after the inevitable pause in the market due to the initial Covid-19 lockdown. According to the report, a net balance of 65% of Savills development teams reported that this was the case in September, increasing from 29% in June and -75% in April.

The need to make up for the lack of land buying since March has driven competition for sites which has sustained values in many markets.

Housebuilders resume land buying albeit with caution

The major housebuilders have re-entered the land market and in general are the most active players for sites of c.100-150 units outside of London. But approaches are varied: there are those who are actively pursuing attractive land opportunities, adding to their pipelines, those who are focusing on a fast build and sell model with smaller sites and those who are more cautious, opting for sites with strong margins.

Sites under 150 units appeal to a range of players including regional housebuilders, housing associations and also major housebuilders needing to fill gaps in pipelines and wanting to build out sites quickly. Parties are also showing a preference for house-led sites as those looking to be risk averse are being more cautious of apartment schemes.

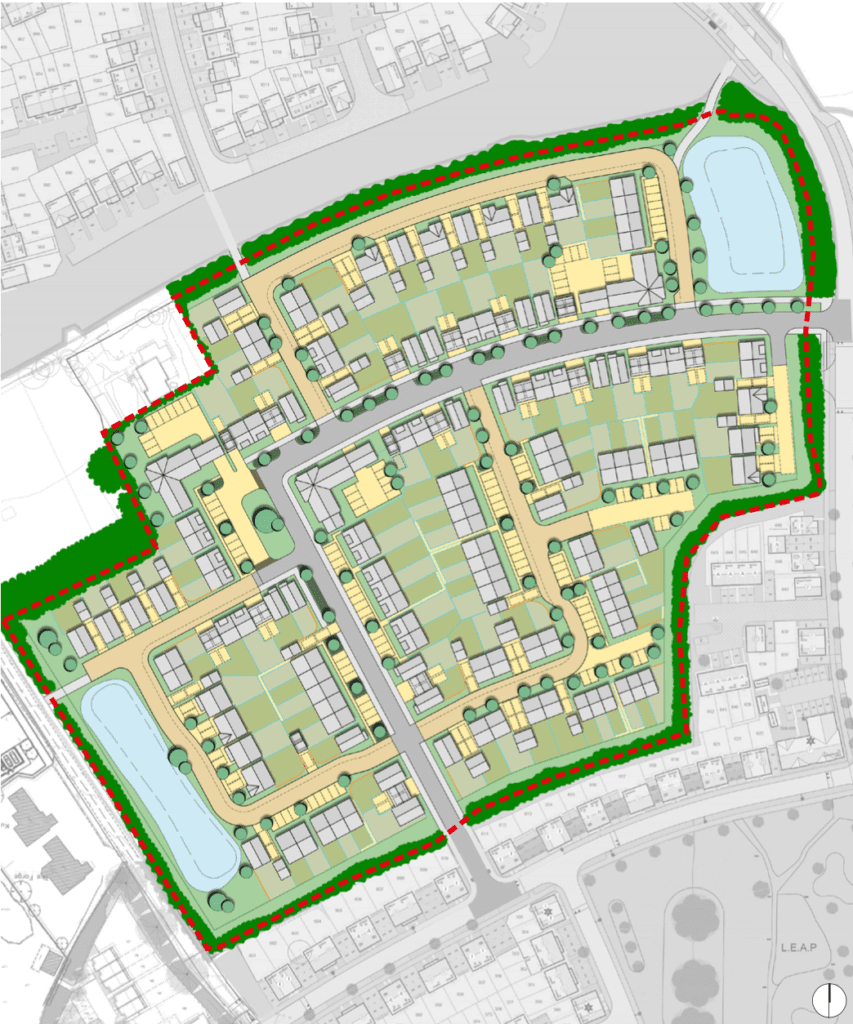

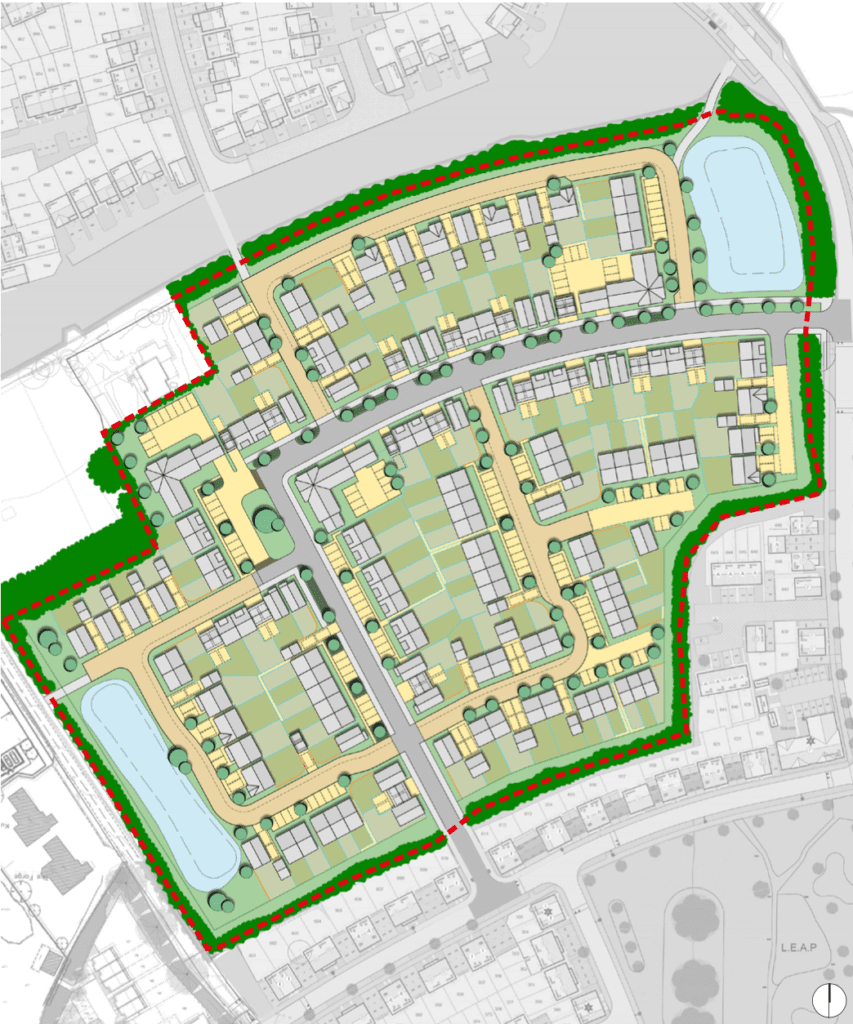

Scott Caldwell, head of development for Savills Cardiff, confirmed that interest for sites of around 150 units was high in Wales, saying “we are currently marketing two sites that hit the sweet spot of current focus. With planning permission for 112 dwellings we have one site in the prime location of west Swansea and an allocated site adjacent to the popular St. Edeyrns development in Cardiff, identified for approximately 160 new homes. Both sites have attracted strong interest from the major housebuilders with closing dates for bids imminent on both.”

“We are also experiencing a very buoyant market at the smaller end of the scale with a number of site opportunities across South Wales in areas such as Swansea, Powys and Monmouthshire. These sites have recently sold or are under offer at pre Covid-19 price expectations or higher and have received competitive bidding from housing associations and regional developers.”

Focus on investment in existing stock for housing associations

According to the Savills Housing Sector Survey 2020, Covid-19 has tempered sector appetite for risk. The survey also revealed a focus on investing in existing stock to meet building safety standards in the short term and net zero carbon standards in the longer term.

However, there is still some appetite for development amongst housing associations. According to the Inside Housing Survey in 2020, the top 50 housing associations based on their development pipelines are still planning to build 39,000 homes in 2020/21, a 4% reduction on completions in 2019/20.

Scott added: “Currently, in the Welsh market we are seeing very little let-up from those housing associations with development capability. Going forwards it will be interesting to see how this balances with the need to invest in decarbonisation of existing stock.”

“Additional funding was released at the end of 2019 to support the delivery of new homes including social housing grant as well as more flexible initiatives such as land loans, a land release fund, funding toward modular build and an extension to the innovative housing partnership fund. Many of these funding opportunities are time sensitive and activity in the Welsh land market maintained momentum during Q3 as a result.”

Leave a Reply

View Comments