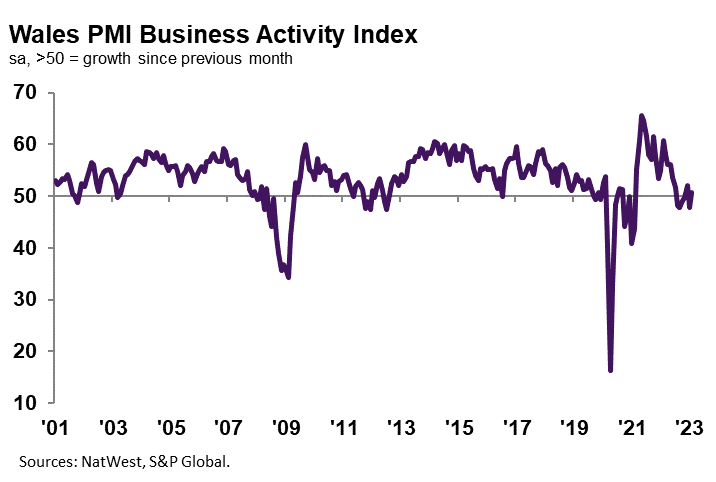

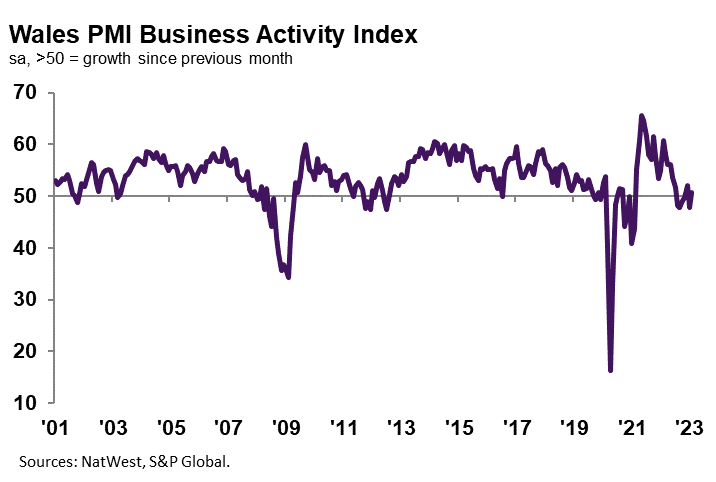

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 50.7 in February, up from 47.7 in January. Welsh firms signalled a renewed rise in output midway through the first quarter following a solid fall at the start of the year. Some companies noted there were signs of stronger demand conditions as new business fell at a softer pace. The rate of expansion was only marginal overall, however, and slower than the UK average.

Welsh private sector firms signalled a fractional fall in new orders during February. The rate of contraction softened from the modest decline seen in January. Although firms continued to mention subdued demand conditions, some companies noted signs of an improvement in client enquiries.

The decline in new business contrasted with a solid expansion seen across the UK as a whole.

February data indicated an improvement in business confidence regarding the outlook for output over the coming year at Welsh private sector firms. The degree of optimism strengthened to the highest in almost a year, albeit slightly below the UK average. Anecdotal evidence suggested that positive sentiment stemmed from hopes of an uptick in demand conditions, investment in marketing and new product launches.

Welsh firms recorded a second successive monthly fall in employment midway through the first quarter. The rate of job shedding quickened to a solid pace that was the fastest since January 2021. Subdued demand conditions reportedly drove the latest fall in workforce numbers, as firms did not replace voluntary leavers, and some staff were let go amid cost cutting measures. Of the 12 monitored UK areas, Wales registered the sharpest decline.

Welsh private sector firms registered a tenth consecutive monthly drop in backlogs of work during February. Lower levels of outstanding business were linked to weak client demand. Although the rate of contraction eased, it was solid overall and faster than the long-run series average. Manufacturers and service providers signalled a fall in incomplete business, with goods producers recording the sharper decrease.

Welsh private sector firms signalled a further marked rise in cost burdens during February. Higher input prices were attributed to greater material, supplier and utility costs. That said, the rate of increase eased to the slowest since April 2021 and reflected the broader UK trend which also indicated a softer uptick in costs. Welsh service providers recorded a much faster rise in input prices than their manufacturing counterparts.

February data indicated a sharp uptick in output charges across the Welsh private sector. Greater selling prices were often linked to the pass through of higher costs to customers. The rate of charge inflation was slightly quicker than the UK average, despite slowing to the weakest since May 2021.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh firms registered a return to growth of output in February, as new business fell at only a fractional pace. Some reports of improving demand conditions emerged as inflationary pressures softened again. Nonetheless, spare capacity remained across manufacturers and service providers, with companies cutting staffing numbers at the sharpest rate since the start of 2021.

“Firms were more upbeat regarding future output, however. Partially supporting greater expectations for activity was a softer rise in cost burdens. Input prices and output charges rose at historically elevated paces, but at the slowest rates since the second quarter of 2021.”

Leave a Reply

View Comments