The average house price in Wales has fallen to £245,101 at the start of 2023 – the first drop since the Covid pandemic – down 1.6% on last quarter’s record high of just over £249,000.

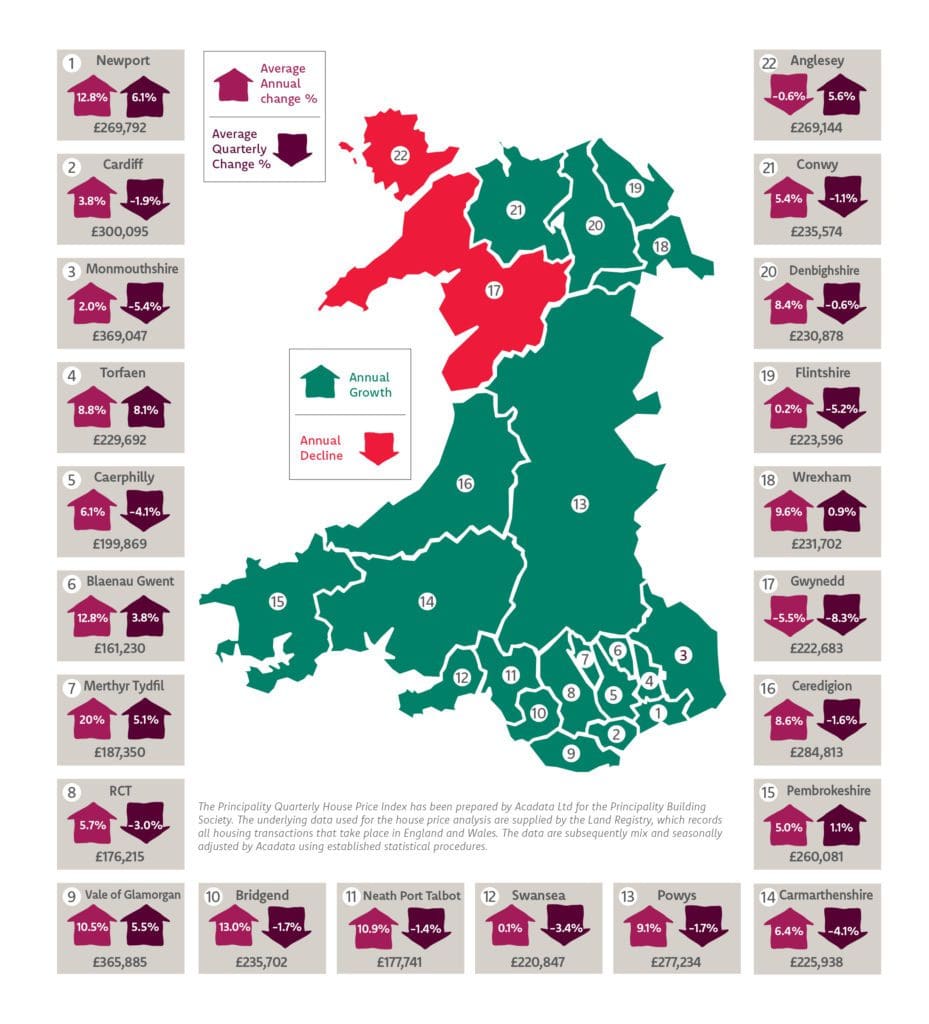

The figures have been released from Principality Building Society’s Wales House Price Index for Q1 2023 (January-March), which demonstrates the rise and fall in house prices in each of the 22 local authorities in Wales.

The quarterly drop has meant that compared to the same period the previous year, the annual price rise is 5%, half the rate of three months earlier and the lowest annual increase since 2020.

This subdued picture is reflected across Wales in Q1, with more local authorities reporting quarterly price falls than increases. Principality’s House Price Index shows that only four of the 22 local authorities reported new peak prices – Blaenau Gwent, Newport, Vale of Glamorgan and Torfaen.

Transaction levels were hit significantly following last autumn’s mini-budget and the subsequent increase in interest and mortgage rates. As a result, activity in January-March 2023 was the weakest since 2020 pandemic levels, with sales down 17% year on year and 26% quarterly, to a figure of just over 9100 transactions.

Shaun Middleton, Head of Distribution at Principality Building Society, said: “Much like the rest of the UK, housing market conditions in Wales are more subdued than in previous quarters. We are at a point in the housing market cycle where wider economic factors are weighing more heavily on, and affecting the existing underlying demand for homes. Future prices will be determined by key variables such as the movement of interest rates, inflation and the impact of the cost of living crisis.

“The radical shift in mortgage rates over the last year cannot be disregarded, moving from a decade at around 2% to closer to 5% in the space of 12 months. We expect rates to settle around this level for the remainder of 2023 and into 2024. We are seeing increased signs of lenders competing to attract business: rates have been edging down and lenders are looking for new ways to support borrowers who are struggling with mortgage affordability.”

Compared with a year earlier, property prices in 20 of the 22 local authorities have still increased, with only Gwynedd and Anglesey reporting annual falls in nominal terms (down 5.5% and 0.6% respectively), while Flintshire, Monmouthshire and Swansea reported only very modest increases (0.2%, 2% and 0.1%).

Six local authorities saw double-digit annual increases in house prices – Newport, Blaenau Gwent, Vale of Glamorgan, Bridgend, Neath Port Talbot and Merthyr Tydfil, which tops the annual increase table with a gain of 20%.

Shaun continued: “The picture across Wales in terms of Q1 price movements was quite varied and we would expect this to continue. Although there have been suggestions of a major housing market correction, such gloomy views have softened in recent weeks, reflecting the slightly better-than-expected performance of the UK economy. There are some positives that the market is settling to its new level.”

The reported drop in transactions is consistent across all property types, however sales of detached properties continue to lag – down 23% over the year. This appears to be part of a general trend, possibly reflecting the after effects of a post-pandemic rush to buy detached properties, along with more recent cost-of-living and affordability pressures, resulting in greater demand for smaller homes and an accompanying reduced demand for larger properties.

The average price by property type in Wales for Q1 is reported to be £364,275 for detached homes, £226,347 for semi-detached homes, £171,290 for terraced homes and £152,576 for flats.