The average house price in Wales has dipped to £242,076 in the second quarter of 2023, down 1.2% since last quarter. This is the second consecutive quarterly fall in 2023 and demonstrates a decline of more than £3,000 since March.

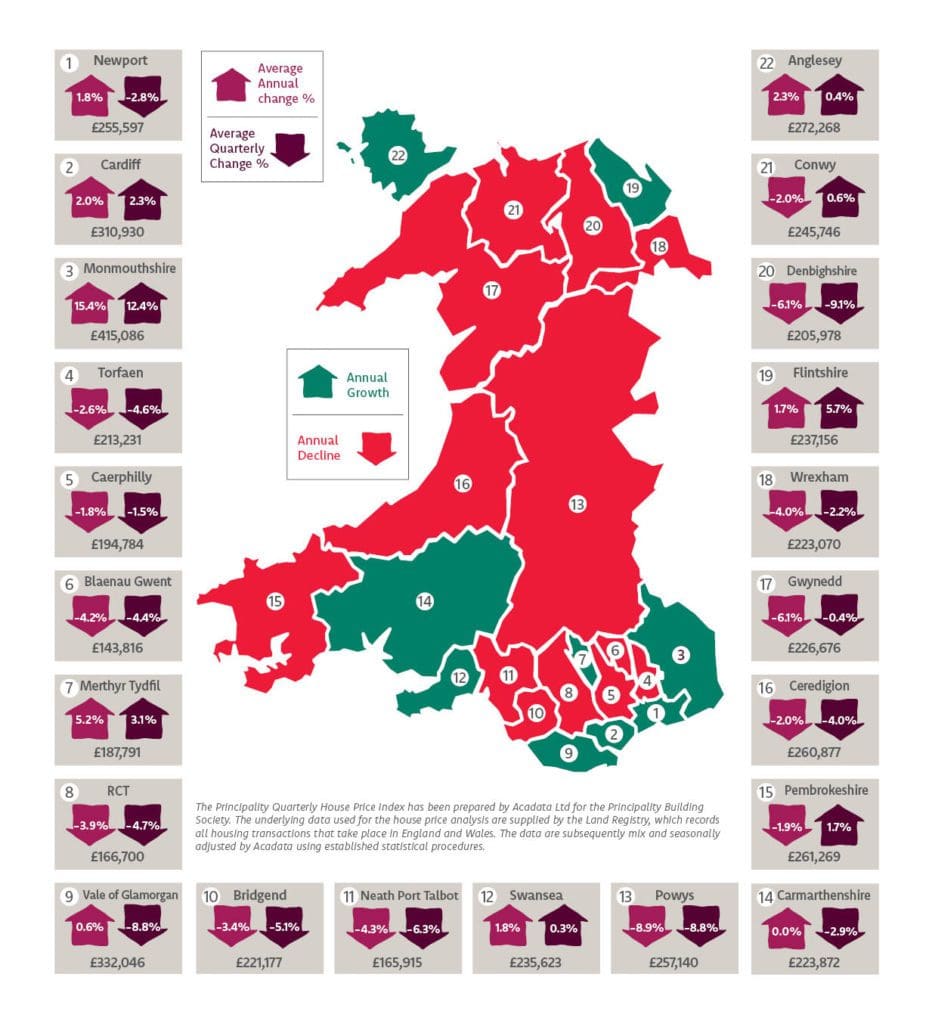

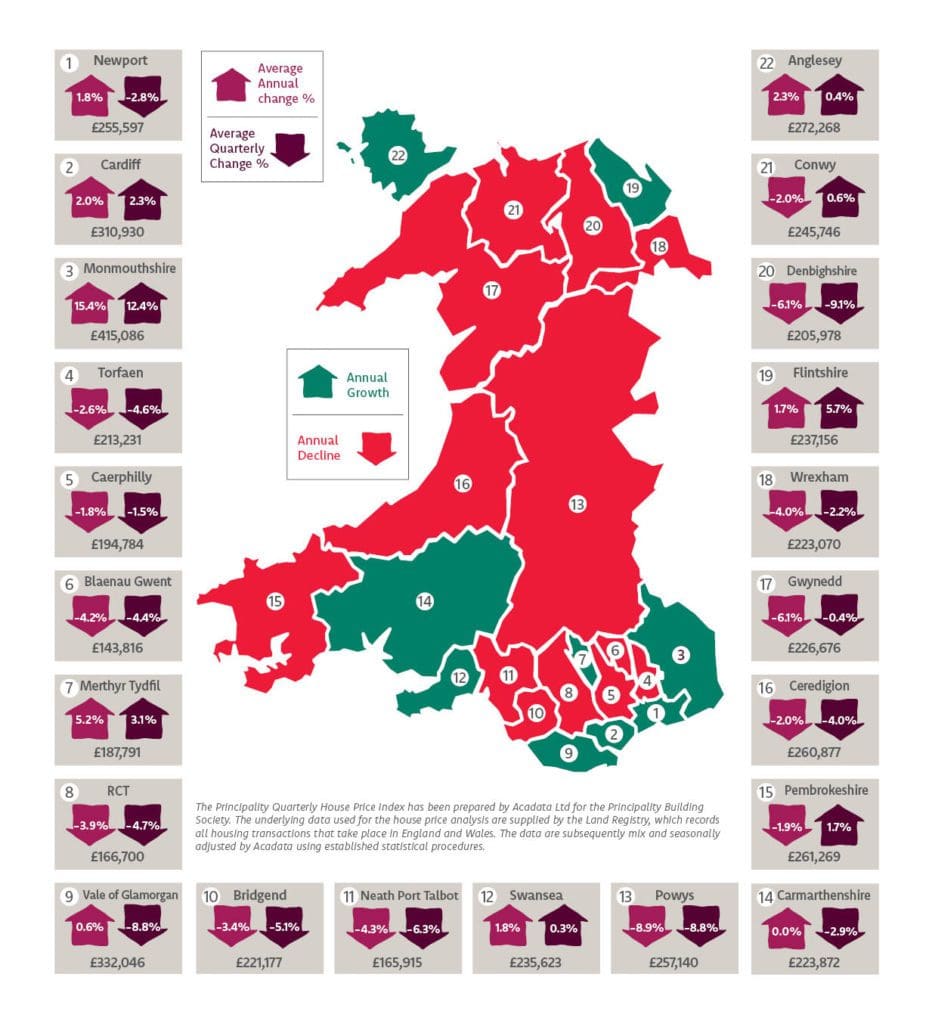

The figures have been released from Principality Building Society’s Wales House Price Index for Q2 2023 (April-June), which reports the rise and fall in house prices in each of the 22 local authorities in Wales.

Compared to the same period the previous year, the annual price rise is now under 1%, the largest slowdown in annual house price growth for almost a decade.

Across Wales, local authorities also continue to report a slowdown in the housing market. Principality’s House Price Index shows that for the second quarter in a row, more local authorities are reporting quarterly price falls than increases, with Cardiff being the only local authority to record a new peak price of £310,930.

There were fewer than 8,500 transactions in Wales in Q2, a modest 5% fall compared with the previous quarter, but down 24% on a year ago, this comes as interest rates continue to rise along with the increased cost of mortgages.

Shaun Middleton, Head of Distribution at Principality Building Society, said: “In Spring we saw a few signs that market sentiment was recovering, after being hit badly by the turmoil following the UK Government’s Autumn mini-Budget. However, activity in Q2 has been a little weaker than in Q1 and further weakness now seems likely. This picture is repeated across Wales, with the significant majority of local authorities reporting price falls in the latest quarter, as well as year-on-year.”

Compared with a year earlier, property prices in 9 of the 22 local authorities have still increased, with only Denbighshire, Gwynedd and Powys reporting annual falls of more than 5% (6.1%, 6.1% and 8.9%).

The local authority of Monmouthshire reported both the largest quarterly and annual increases at 12.4% and 15.4% respectively, bringing the new average house price to £415,000.

When comparing average price by property type in Wales, detached homes are the only type maintaining a slight increase year-on-year with a 0.7% annual rise to a new average price of £360,302. While average prices for semi-detached homes have fallen annually by 1.1% to £219,460, terraced homes have fallen by 1% to £171,546 and flats have fallen by 4% to £154,508 when compared to the same period last year.

Shaun continued: “Our last outlook offered up a modestly optimistic view of the future based on the market expectation that interest rates were nearing their peak. However, since then, to fight inflation, the Bank of England has continued to raise the base rate with a 0.25% rise in May and a 0.5% rise in June (so currently standing at 5%).

“Financial markets are now expecting further rises, continuing throughout 2023 and into 2024, perhaps peaking at 6.5%. Constant rate rises have led to mortgage product repricing, and inevitably this has been disruptive. Higher rates also impact the amount people can afford to borrow, as a result sellers have found it harder to attract buyers and some have been forced to offer discounts and lower their expectations in order to secure sales. While few are forecasting a full-scale housing market recession, it is quite clear that the market is becoming more difficult.”

Leave a Reply

View Comments