Construction workloads in Wales rose through Q2 of 2024 according to the latest Royal Institution of Chartered Surveyors (RICS) Construction Monitor, with public housing rising fastest out of all subsectors.

A net balance of 15% of surveyors report that workloads rose through the second quarter of the year, up from 2% that was seen in Q1. Looking at the subsectors, Welsh surveyors report that all saw increases, bar private housing activity which was noted to have fallen flat.

A net balance of 29% saw a rise in public housing activity, 6% in other public works, 14% in private industrial, 18% in infrastructure and 6% in private commercial, the first time this subsector has been in positive territory since mid-2022.

Surveyors in Wales are more optimistic looking forward when it comes to workloads too with a net balance of 28% of respondents expecting a rise over the next year. This is up from 14% that was seen earlier this year.

Profit margins are also expected to rise for the first time since before the pandemic. A net balance of 10% of Welsh surveyors anticipate that profit margins will increase over the next year, the first time this figure has been in positive territory since late 2019.

Welsh surveyors continue to report shortages in skilled workers. 55% report a shortage in quantity surveyors, up from 50% in Q1, 48% note a shortfall in other construction professionals up from 38% and 51% reporting a deficit in bricklayers.

Jodie O’Connor of Penfro Consultancy Limited in Pembroke Dock commented: “Rural areas make it difficult to uptake all renewable options as service provision and contractors for installation are not easy to come by.”

Aaron Treliving of Treliving Real Estate Limited said that a lack of suitable resources in planning departments and the impact of the Building Safety Act were affecting the market.

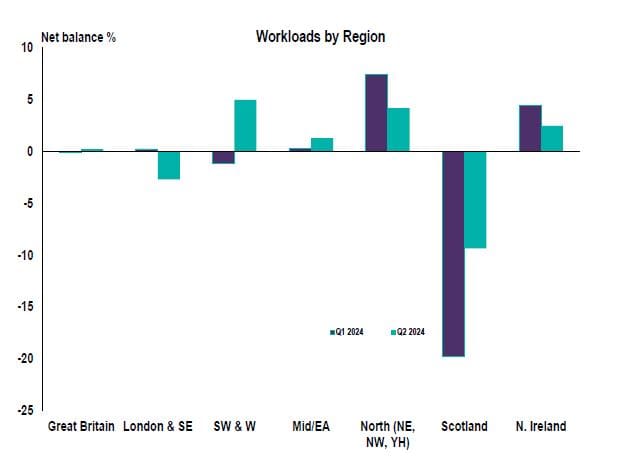

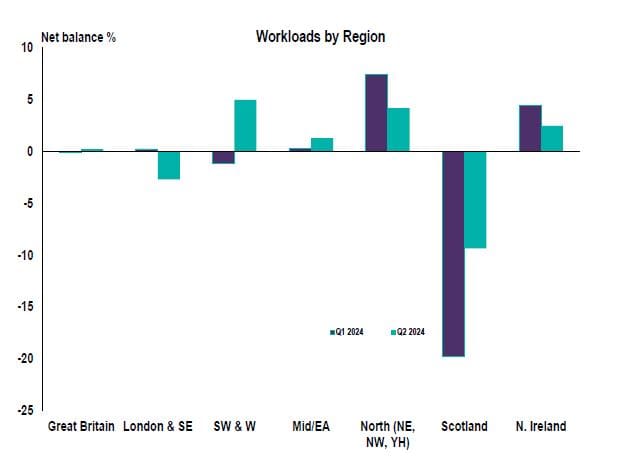

Commenting on the UK picture, RICS Chief Economist, Simon Rubinsohn, said: “The overall tone of the feedback received to the Q2 RICS Construction Monitor is still pretty flat, although the forward-looking indicators are a little brighter even in the area of residential development, possibly reflecting some of the ambitious talk from the new government about ‘getting Britain building’.

“However, there are some major challenges identified by respondents that need addressing to secure the more meaningful uplift in both housing and infrastructure that appears to now be the focus of policy. In particular, planning reform was very much front and centre in many of the remarks from a large number of contributors, and it will be interesting to see the impact in our figures of this weeks planning and housing announcements.

“Concerns around finance remain prevalent although there is a sense that credit conditions in the construction sector will gradually improve helped by the prospect of the Bank of England beginning to lower interest rates.”

Leave a Reply

View Comments