Financial markets may seem confusing, but essentially they exist to bring people together and money to flow where it is needed the most. However, shares may need substantial funds to purchase enough quantities to enjoy massive earnings due to their price fluctuations. The solution to this issue is leveraged investment markets which enable traders to receive enough market unmasking by financing only a minor down payment on the price of the fundamental valuables they’re revealed to for a specific time. Spread Betting and CFDs fall under these products.

If you’re interested in trading in 2022, you’re most likely targeting one of three markets: stocks, Forex, and cryptocurrency. Whatever trader you are, it is very important to learn the market, the tools to be used, the skills that need to be acquired and even strategies that can help you in your success.

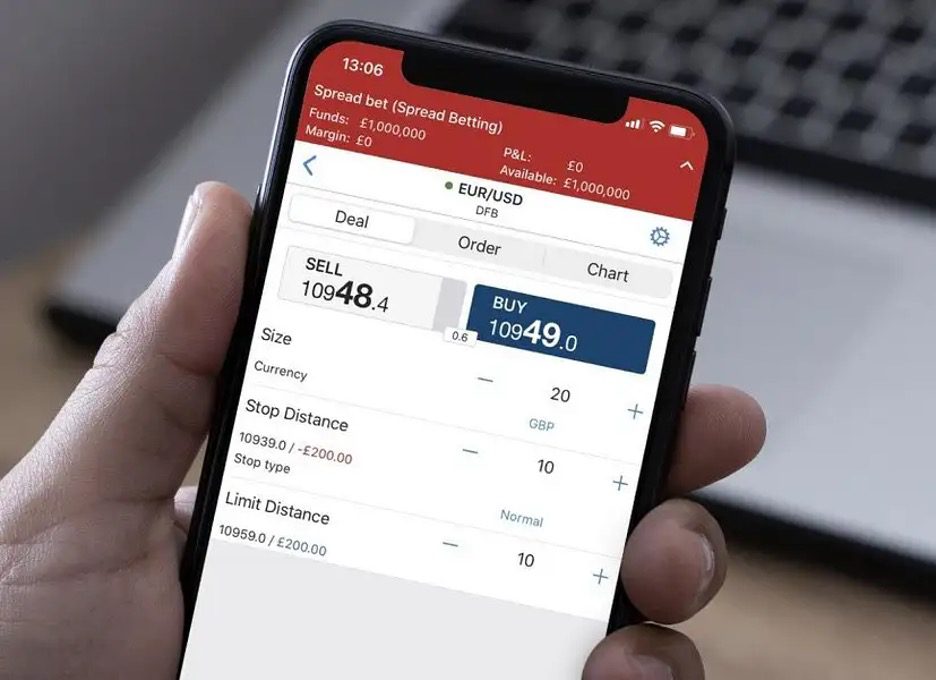

If you come from Wales, Ireland, or the UK, you can trade CFDs or do a spread bet using your retail trading accounts. Spread betting stands out as a famous replacement to the highly practiced CFD trading because of its several ways of making profits and tax benefits compared to the Contracts For Difference trading.

Both trading styles are leveraged products, stamp duty-free, and make it easy to access international markets. However, primary distinctions of spread betting and Contracts For Difference trading exist, such as product range. It’s pivotal to note that spread bets and CFDs fall under complicated apparatus, and they always feature a high money-losing risk. Although you can generate profits with spread bets and CFD trading whenever you trade over-the-counter financial trades, it’s pivotal to remain aware of the high money-losing risk and note the investing tools you can rely on to mitigate this and other threats.

Contracts For Difference Definition

A CFD refers to a derivative item that enables you to hypothesize if a financial tool’s market value will jump up or drop down in a limited time. A CFD investor is not literally buying the fundamental asset/value, but instead, the trader focuses on hypothesizing on the asset’s future value movements.

You can create investment strategies that involve CFDs obtained from different asset categories, ranging from commodities and shares to forex. Until not long ago, UK CFD trading providers could provide crypto CFDs such as bitcoin assets, yet the Financial Conduct Authority lately prohibited retail investors from trading cryptos because of high volatility/risk.

Spread Betting Definition

Like Contracts For Difference trading, spread betting does not take the underlying asset’s physical ownership. Instead, your bet relies on if you expect a financial tool’s market value to jump up or drop down in the upcoming days. Every time you ‘spread bet,’ you follow a short or long position using a pre-decided amount of funds per fluctuation point in the value price.

Like Contracts For Difference trading, you’re free to spread bets to the several items obtained from fundamental markets, such as bonds, currency pairs, and indices. Some spread betting providers take an extra mile and offer spread betting options on sporting activities like rugby, horse racing, and tennis.

Key Distinctions

Profit tax treatment is what creates the primary difference between these derivative items. You’re required to pay CGT, also known as capital gains tax, every time you trade CFDs and make a profit. However, there’s no stamp duty in this case.

As traders dive into price action trading, they often look for specific patterns to gauge potential market movements. Some traders, particularly those relying on clean chart analysis, also explore techniques like trendlines or candlestick patterns.

Although it relies on personal situations, spread betting profits don’t incur any taxes for most investors. You don’t pay stamp duty or capital gains tax on the spread betting case, meaning spread betting is more tax-effective than CFD investment for Ireland and United Kingdom residents.

Conclusion

Whether your focus is on CFD trading or ‘spread betting,’ your initial step should concentrate on opening a demo trading account. Demo trading accounts enable you to train trading on the financial trades without facing the money-losing risk. Therefore, a demo trading account provides an exceptional environment to build your confidence level and identify a trading provider matching your investment requirements. Since both trading styles entail margined items, demo trading accounts act as exceptional risk management instruments, enabling you to train and boost your trading master plans without experiencing the high risk associated with real-time trading.

Leave a Reply

View Comments