During the current period of uncertainty brought on by the pandemic, some economic sectors are already experiencing a swift rebound. Commercial real estate experienced a sort of renaissance, and it’s a tempting target for many investors right now. A few countries are showing more positive growth than others, mostly for COVID regulation reasons. Today we will take a look at a market that’s on a trajectory to peak, fueled by years of stalling and falling behind.

David Kezerashvili: Local Knowledge is Key

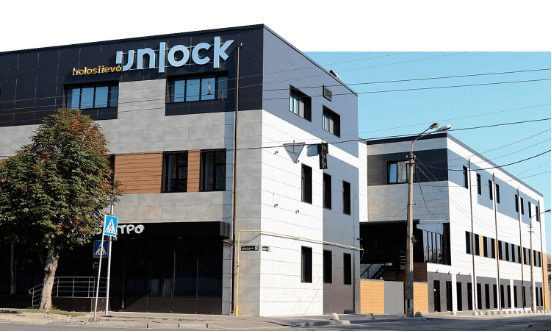

To understand any local market, it’s best to consult with a firm or experts that have been in the area for some time. Today we will take a look at the insights of one such expert on Ukraine’s market. David Kezerashvili’s insights as an owner of Unlock Group, a real estate investment firm in Ukraine, are important to consider. His company is focused on modernizing aging buildings and developing new commercial real estate in Ukraine.

The Why Behind The Boom

No matter how much investors with money prefer predictable outcomes, there still has to be supply and demand in any location for it to have potential. Kyiv is an emerging hub spot for all areas of technological development, including IT and science. Foreign companies are flocking here and looking for office space. Modern spaces where they can place both their own talent and local hires. Kyiv is a place where all the promising works relocate, and there are thousands of experts across many industries living here.

Another important factor driving real estate markets in Ukraine is price. Compared to all other major cities in Eastern Europe and the Balkans, Ukraine has much lower pricing per capita. If each square meter is cheaper, that adds up quickly to savings for an investor. Kyiv’s housing market is currently much more affordable than most of Europe making it a prime place to invest now.

Most Important Statistics

Ukraine is much bigger than all of its neighbors or other Post-Soviet states, except for Russia. Kyiv is more populous than Paris, and only little behind other world capitals like Berlin and Madrid. Population numbers drive demand, and with a population of three million, Kyiv has a great deal of demand here. The more people, the more employees for business to hire, and more business space and office required. Amsterdam for example has a three times lower population, but the average price per centare is almost three times higher.

The Specifics

The devil is in the details as they say. If you are not a local, getting the details can get a little hard. This is where a firm like Kezerashvili’s Unlock Group comes into play. They can help you figure out exactly what it is you should be looking for. With local knowledge they can accurately assist in figuring out potential yields and ROIs. It’s not only the numbers that are important. If you get a warehouse during a lockdown, profits might be bleak no matter how lucrative they seemed before it was installed.

There is no one size fits all answer for what exactly is the best in any city, and Kyiv is no exception. Local expertise is not a suggestion but a necessity in this situation but do not neglect your own due diligence. Covid has changed the game, in unpredictable ways, as well. Even though a lot of workers moved to work-from-home situations, only a partial percentage will remain that way. When everything is back to normal if a few vacant buildings pop up, it’s not a big deal because there are almost none of them here, that’s how dense and popular Kyiv is.

Leave a Reply

View Comments