House prices in Wales rose through the month of June according to the latest Royal Institution of Chartered Surveyors (RICS) Residential Market Survey, resulting from a rise in demand and a fall in supply.

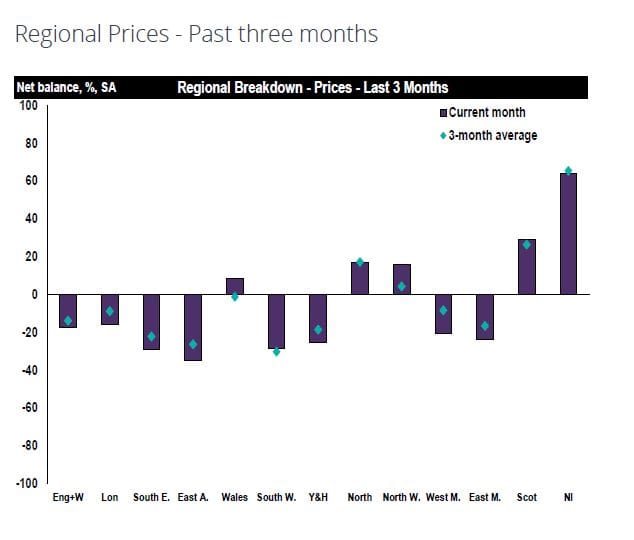

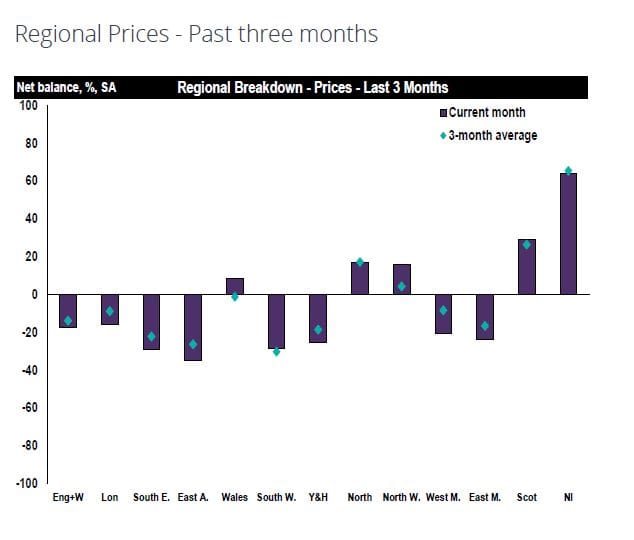

A net balance of 8% of surveyors in Wales reported that house prices had increased in the most recent survey, up from -4% in May and -8% in April. And surveyors expect this trend to continue with a net balance of 13% of respondents anticipating a rise in prices through the third quarter of the year.

This appears to be the result of a rise in demand as a net balance of 31% of Welsh surveyors report that new buyer enquiries rose through the month of June, the seventh month this figure has remained in positive territory, and a drop in supply.

June’s survey saw a net balance of -30% of respondents in Wales noting a decrease in new instructions to sell. This is the lowest this balance has been since August last year.

On the sales front, surveyors in Wales report that sales fell flat in the most recent survey. In saying this, respondents are more optimistic about the coming months as a net balance of 32% of surveyors anticipate sales will rise over the next three months, up from 16% in May.

There remains an imbalance between supply and demand in the lettings market in Wales with a net balance of 40% of Welsh surveyors reporting a rise in demand (up from 17%), and a net balance of -17% noting a fall in supply (the same figure that was seen in May). As a result, a net balance of 50% of surveyors in Wales expect rents to rise through Q3.

Commenting on the sales market, William Graham, FRICS of Graham & Co in Newport said: “We are seeing increased demand with fewer properties available resulting in higher prices, with asking prices beginning to be exceeded. A fall in mortgage rates will accentuate present trend.”

Tim Goodwin, AssocRICS of Williams & Goodwin The Property People in Gwynedd added: “Seasonal factors and a wait to see approach with the election has seen a slight fall in activity but there is still a shortage of new instructions and realistic prices coming to the market.”

Discussing the lettings market, Anthony Filice, FRICS of Kelvin Francis Ltd. In Cardiff commented: “There is a wider choice of rental properties and some landlords are considering offers on rents. However, Landlords are still exiting the market, due to increasing regulation, and costs, reducing tax allowances, lower returns and general uncertainty.”

Commenting on the UK picture, Tarrant Parsons, RICS Senior Economist, said: “Although activity across the housing market remained subdued last month, forward looking aspects of the results did improve slightly.

“There are a couple of factors emerging that could support a gentle recovery in the months ahead. Perhaps most importantly, swap rates have eased in recent days, and this should allow banks to reduce mortgage rates, albeit modestly for now.

“If the Bank of England does decide that the current inflation backdrop is benign enough to start loosening monetary policy from next month, this may prompt a further softening in lending rates. Also, the recent election delivered a clear outcome, with housing seemingly pushed up the political agenda. As such, this could act to restore some confidence in the market moving forward”.

Leave a Reply

View Comments