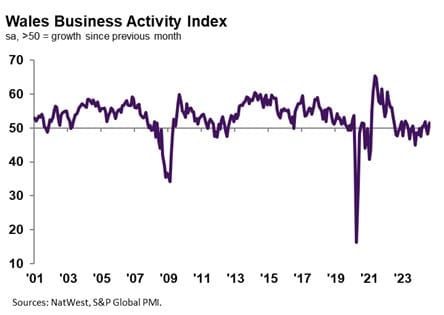

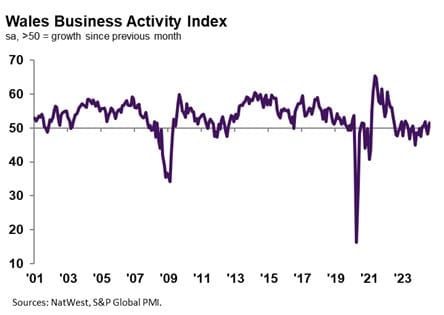

Welsh firms signalled a return to output growth during August, according to the NatWest Wales Growth Tracker. The headline Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 51.5, up from 48.3 in July to record a renewed rise in output midway through the third quarter, thereby ending a two-month sequence of decline. The upturn in activity was linked by panellists to stronger demand conditions and a further increase in new orders.

August data signalled a second successive monthly expansion in new orders at Welsh firms, with the pace of increase accelerating to the fastest since April. Anecdotal evidence attributed the rise in sales to new client wins and more favourable demand conditions. The rate of growth was modest but slower than both the long-run series and UK averages.

Welsh companies continued to record a historically sharp rise in input prices during August. The rate of cost inflation was unchanged from July and the joint-fastest since April.

Although stronger than the historic trend level, the degree of confidence at Welsh companies dipped to the lowest since January. Nevertheless, firms anticipate output growth over the coming year, supported by hopes of further improvements in the sales environment and investment in building capacity.

Private sector firms in Wales registered a sixth consecutive monthly rise in employment during August.

Jessica Shipman, Chair, NatWest Cymru Regional Board, said: “A return to growth in business activity during August, sparked by a stronger rise in new orders, buoyed Welsh companies. Moreover, the expansion in new sales was the quickest since April and driven by new client wins. Despite business confidence slipping from July, the level of optimism was still historically marked, with firms continuing to bring on additional staff to build capacity.

“Cost pressures also remained substantial, however. Strain on margins from efforts to hold back from passing higher input prices through to clients intensified, meanwhile. Although the rate of cost inflation was unchanged from July, Welsh businesses moderated the pace of increase in selling prices to the slowest since January 2021.”

All 12 monitored UK regions and nations recorded an expansion in business activity in the latest survey period, however, Welsh firms indicated the second-slowest pace of growth, with only the North East posting a weaker rise in output.

Welsh firms recorded one of the slowest expansions in new business of the 12 monitored UK regions and nations. The West Midlands and Scotland were the only areas to register weaker increases.

Meanwhile, the degree of confidence in the outlook for output at Welsh companies was below the UK average.

The pace of job creation eased to only a marginal rate that was the slowest since April. Although comparing favourably with the long-run series average, the pace of employment growth was softer than the UK trend.

In line with greater workforce numbers, firms were able to deplete their backlogs at a sharper rate in August. The level of outstanding business dropped at the quickest pace in 2024 so far, and was the steepest decline seen among the 12 monitored UK areas.

Moreover, of the 12 monitored UK regions and nations, only firms in Northern Ireland registered a quicker uptick in operating expenses. Greater wage bills, alongside higher costs for raw materials including plastics, resins and food reportedly drove inflation, according to panellists.

Meanwhile, Welsh businesses continued to raise selling prices midway through the third quarter. That said, the pace of inflation slowed to the weakest since January 2021. As well as being historically subdued, the rate of increase was the slowest of the 12 monitored UK areas. Some companies noted efforts to hold back on passing through costs to customers.

Leave a Reply

View Comments