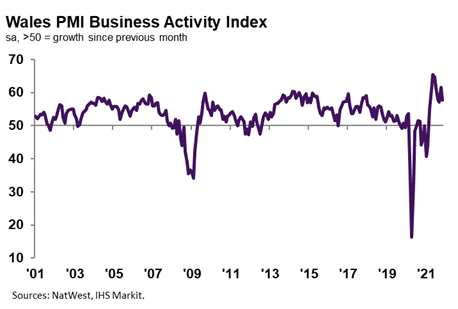

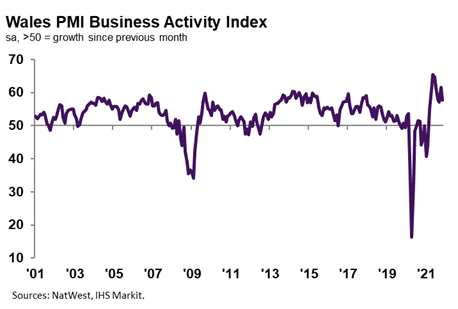

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 57.6 in November, down from 61.5 in October, to indicate a sharp expansion in business activity across the Welsh private sector. The rate of growth was in line with the UK average despite easing from October’s marked upturn. The increase in output was often linked to a sustained uptick in client demand. That said, the expansion was reportedly weighed down by material shortages.

Welsh private sector firms signalled a further marked expansion in new business during November, albeit at the slowest pace for eight months. Where an increase in new work was reported, firms linked this to a sustained rise in client demand. Despite easing, the pace of growth was the second-fastest of the 12 monitored UK areas, slower than only London.

Private sector firms in Wales registered stronger expectations regarding the outlook for output over the coming year in November. The level of optimism was the greatest on record (since July 2012) and commonly linked to investment in technology and hopes of further upticks in client demand. Of the 12 monitored UK areas, only firms in Yorkshire & Humber recorded a higher degree of positive sentiment.

November data signalled a solid rise in employment across the Welsh private sector. Greater workforce numbers were often attributed to efforts to clear backlogs following a further increase in new order inflows. That said, challenges retaining staff and difficulties filling open vacancies led to the slowest rate of job creation since May. The pace of expansion in staffing numbers was among the weakest of the 12 monitored UK areas, quicker than only the North East and Scotland.

Welsh private sector firms recorded a sharp increase in the level of outstanding business during November. Although the rate of growth in backlogs of work softened to the slowest since April, firms stated that greater new order inflows, alongside labour and material shortages put pressure on capacity. The pace of increase was also the steepest of the 12 monitored UK areas.

Private sector firms in Wales registered another marked rise in cost burdens midway through the fourth quarter. The rate of input price inflation accelerated to the sharpest on record (since January 2001) and, compared to other UK areas, was slower than only Northern Ireland. Anecdotal evidence suggested that higher costs were due to labour and material shortages, with surging supplier prices and wage bills often cited.

Welsh firms recorded a fractionally faster uptick in average charges during November. The increase in output prices was the steepest since data collection for the series began in January 2001, and, in line with the trend for input costs, was the second-quickest of the monitored UK areas (softer than only Northern Ireland). Welsh companies continued to mention that higher selling prices stemmed from the pass-through of greater costs to clients.

Gemma Casey, NatWest Ecosystem Manager for Wales, commented:

“Welsh private sector firms continued to register a sharp upturn in business activity in November, although rates of expansion in output and new orders slowed amid supply chain disruption. Nonetheless, Wales ranked highly among the monitored UK areas with regards to output and new business growth, second to only London. Further moves towards recovery from the pandemic led optimism to improve to the strongest in almost nine-and-a-half years of data collection for the series.

“Companies struggled once again with surging inflationary pressures, as costs rose at a series record rate. Soaring supplier, fuel and wage costs reportedly drove the uptick. That said, relatively accommodative demand conditions allowed selling prices to also rise at a record pace.”

Leave a Reply

View Comments