Red Kite Credit Union in Llandrindod Wells has become part of a leading Welsh Community Bank bringing full banking services to the area.

It joins Brecon & District Credit Union under the umbrella of Smart Money Cymru Community Bank in a partnership which will bring much-improved financial services to Mid Wales as traditional banks continue to close their doors.

Smart Money Cymru has branches in Caerphilly, Blackwood, Tredegar, Aberdare, Brecon and now Llandrindod Wells, making it one of the fastest-growing financial institutions in Wales with just under 12,000 Members.

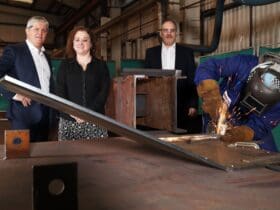

The move will mean better, more accessible premises in the centre of Llandrindod as well as upgraded IT and banking services. “We have ambitious plans to develop services and facilities for Members in Llandrindod Wells and also across Powys,” said Smart Money Cymru CEO Mark White.

“In the first place we will be moving to new, ground floor, premises in the centre of town which will be both easier to access, and will make Red Kite far more visible and bring it into the life of the town.”

Smart Money Cymru, with the help of the Welsh Government, is making substantial investments in Powys. As well as partnering with Brecon & District and Red Kite Credit Unions, Development Officer Andrew Davies has been appointed to promote the benefits of the new services within the County and build links with local communities and organisations. An outreach branch is also planned for Knighton in the near future.

Smart Money Cymru has made enormous strides in the last two years merging with Blackwood, Brecon and now Llandrindod Wells Credit Unions, bringing enhanced financial services to these areas. With support from Welsh Government the organisation has invested in new digital platforms, streamlining lending procedures and enhancing customer service. As a result, Membership has increased, and lending soared by 49% in a year.

With the cost-of-living crisis showing little sign of abating, the battle against financial exclusion is ever more pressing, said Mr White. “Financial pressures on households are immense and are likely to increase, and this is why the work of credit unions and community banks is so important, “he said.

“Our aim is to widen access to fair finance, and to keep people out of the hands of unscrupulous lenders who take advantage of the vulnerable, especially at times like this.”

Another important initiative is Smart Goods, which Smart Money Cymru launched a year ago and will now be available to Llandrindod Members. The scheme allows Members to obtain loans which they then use to buy from a catalogue of 5000 homeware goods such as fridges, freezers and televisions and this has proved very popular.

Two Members of the Red Kite Board, Nicola Roberts and Tom Taylor have joined the Smart Money Cymru Board following the merger.

Leave a Reply

View Comments