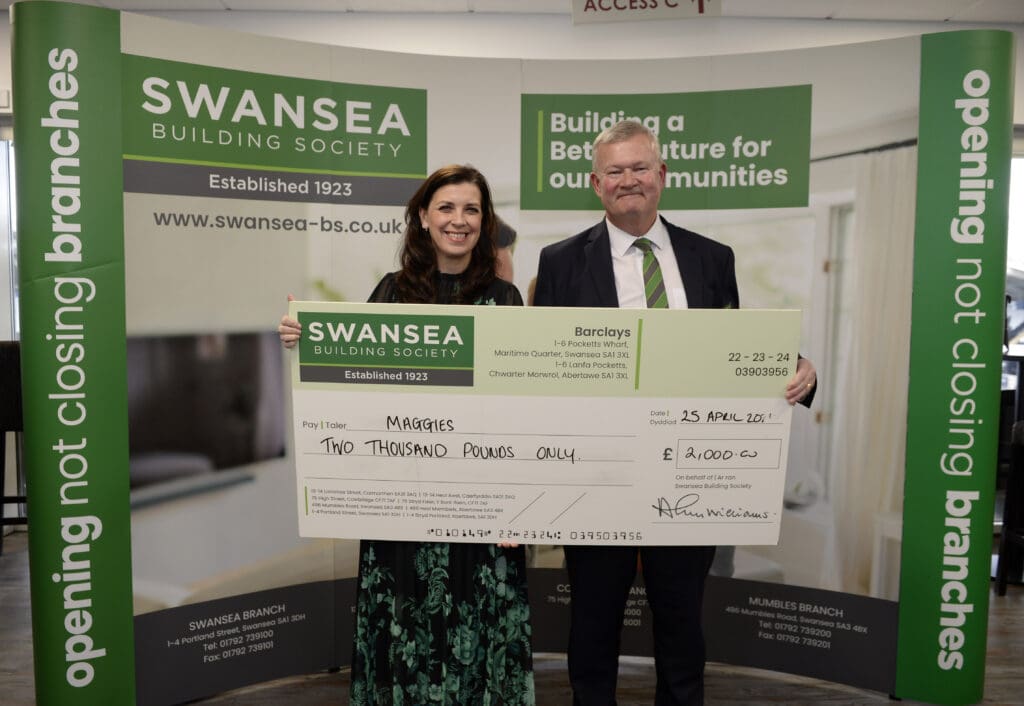

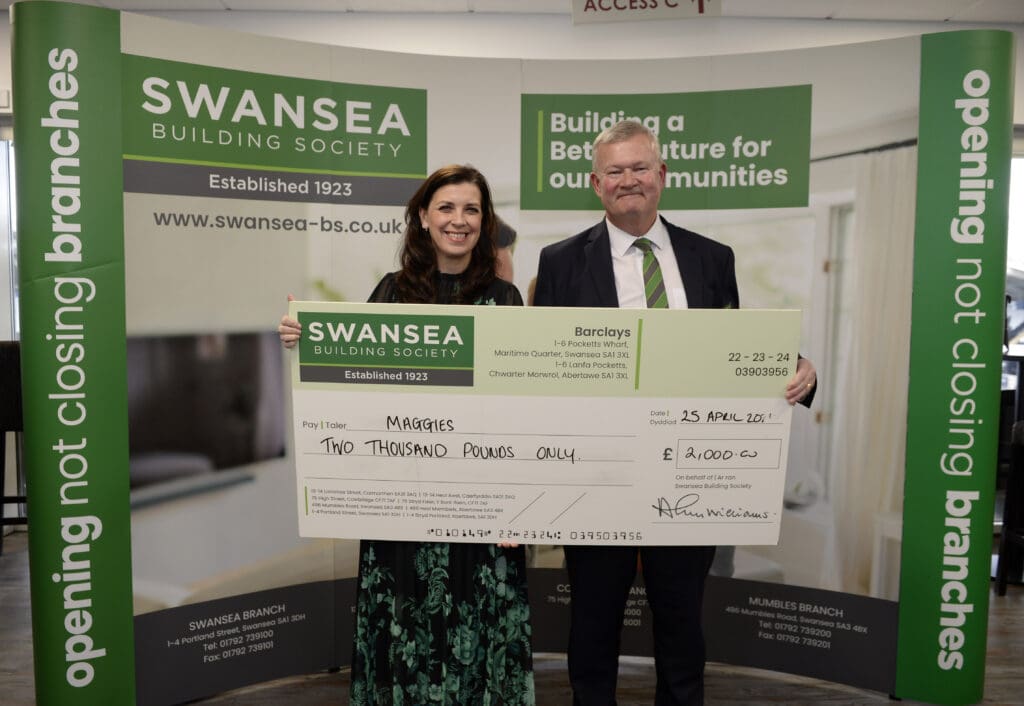

On the back of posting yet another set of record-breaking results, Swansea Building Society held its annual general meeting (AGM) at the Swansea.com stadium yesterday (Thursday, April 25). The Society also presented a substantial cheque to partner charity Maggie’s, donating more than a pound for each vote received.

At the well-attended event the board of the Society presented and explained its best-ever set of results to members as it benefitted from supporting local communities from its growing network of local branches across South Wales while reaping the rewards of an investment programme it started in 2015.

The Society was thanked by a representative from cancer charity Maggie’s, which received almost £20,000 of donations from the Building Society last year. This figure was topped by a further donation of £2,000 rounded up based on the almost 1900 votes it received from members, the highest number of votes ever submitted.

Alun Williams, Chief Executive of Swansea Building Society, said:

“As we reflect on the past year, I am pleased to announce that Swansea Building Society has achieved an unprecedented level of success, despite navigating through turbulent market conditions. Our steadfast commitment to serving the needs of both borrowers and savers amidst a challenging backdrop of cost-of-living crises, fluctuating house prices, and rising interest rates fills me with immense pride.

“Furthermore, throughout our centenary year, the dedication and care exhibited by my colleagues surpassed all expectations, reaffirming our unwavering commitment to our members. Central to our mission is our dedication to social responsibility and community impact. Beyond our core products and services, we have been proud to contribute our time, skills, and resources to support local initiatives. In commemoration of our milestone anniversary last year, we proudly donated an additional £100k to local charities alongside our ongoing support for Maggie’s, our official charity partner.

“Looking ahead, Swansea Building Society is poised to navigate the complexities of today’s economic landscape with confidence. Our strategic focus on digital transformation underscores our commitment to adaptability and innovation, ensuring our members experience continual enhancements in our products and services. The sustained growth and profitability we’ve experienced in recent years will enable us to make strategic investments that benefit both our current and future members.”

Lucia Osmond, Centre Fundraising Manager, Maggie’s, said:

“We extend a massive thanks to Swansea Building Society and are so grateful that the Society has extended its support of our charity for a third year. Our centres now cover the whole of Wales, but we cannot do what we do without this kind of support. So, thanks again to the Society team and its members for their continuing generosity.”

The Society achieved double digit growth in its total assets, mortgages, savings and capital last year despite the difficult economic environment.

For the year to December 31, 2023, total assets grew by 15% driven by mortgages and savings growth of 16% and 15% respectively. Total assets increased by £77.2 million to £607 million, savings balances increased by £72.6 million to £565.5 million, while mortgage balances grew by £66.9 million to £477.8 million. The Society’s mortgage growth was driven by gross mortgage completions of £120.1 million, another record, beating the previous highest set in 2021.

The Society’s growth was supported by record profits before tax of £6.2 million, beating the previous record of £5.4 million achieved in 2022. This increased the Society’s capital reserves to £39.8 million. This is vitally important to the Society, as it provides greater reserves to support members achieve their financial goals.

Swansea Building Society remains one of the few financial institutions in the UK that receives no wholesale funding or support from the Bank of England in the form of cheap funding. Its balance sheet is funded entirely by customer savings balances and its own capital reserves built up from retained profits over many years.

Leave a Reply

View Comments