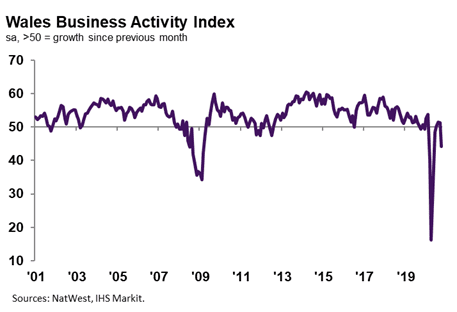

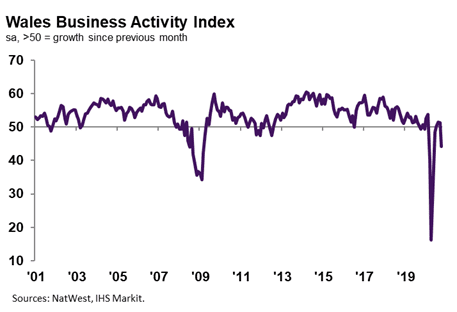

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 44.1 in October, down notably from 51.3 in September, to signal a renewed decline in business activity. The fall in output was the sharpest since May and steep overall. The decrease in activity was often linked by panellists to pressure on capacity following employee illness and reimposed local lockdowns.

Welsh private sector firms signalled a renewed decline in new orders in October, thereby ending a two-month sequence of expansion. The drop in new business was often attributed to reimposed lockdown restrictions across Wales and weaker demand from key export destinations due to a resurgence in virus cases.

The rate of decline was broadly in line with the decrease seen across the UK as a whole.

Private sector firms operating in Wales signalled a stronger degree of confidence regarding the outlook for output over the coming 12 months. Greater optimism among Welsh companies was largely linked to hopes of an end to the ongoing pandemic and a return to pre-pandemic activity levels.

The degree of positive sentiment was higher than that seen across the UK as a whole and historically upbeat.

October data signalled a slower, albeit still marked, decline in workforce numbers across the Welsh private sector. The rate of job shedding was the softest since March, but firms continued to state that lower employment was due to redundancies and efforts to cut costs.

The rate of contraction was among the fastest of the 12 monitored UK regions, slower than only the West Midlands and Scotland.

The level of outstanding business rose in October for the first time in over a year. Although only marginal, the rate of accumulation was the fastest since March 2019. Panellists commonly linked the rise to greater pressure on capacity resulting from sickness among staff and the introduction of a temporary two-week lockdown across Wales.

Of the 12 monitored UK regions, only Wales and Yorkshire & Humber registered increases in work-in-hand.

Welsh private sector firms signalled a steep increase in input prices during October, as the rate of inflation quickened from that seen in September. Higher cost burdens were often linked to supply chain issues due to the ongoing pandemic, and greater vendor prices as a result.

The pace of increase was sharper than the UK average, but softer than the long-run series trend.

Private sector firms in Wales registered another monthly increase in selling prices in October, despite weaker demand conditions. Companies generally linked the uptick to the pass-through of higher costs to clients. That said, the moderate increase in prices was the slowest for three months.

The rise in charges at Welsh firms contrasted with a slight decline seen across the UK as a whole.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Renewed local lockdown measures across Wales in part weighed on business activity in October, as firms struggled to boost sales. The drop in output also led to the first rise in backlogs of work since July 2019, as companies reported that temporary closures had stymied efforts to clear any outstanding business.

“Meanwhile, employment fell further amid redundancies and efforts to rein in costs. Despite a sharper rise in input prices, output charges increased at only a modest pace as demand conditions remained challenging.

“Nevertheless, companies were more upbeat regarding the year-ahead outlook for output. Hopes of an end to the ongoing pandemic and return to pre-pandemic activity levels by October 2021 spurred greater optimism.”

Leave a Reply

View Comments