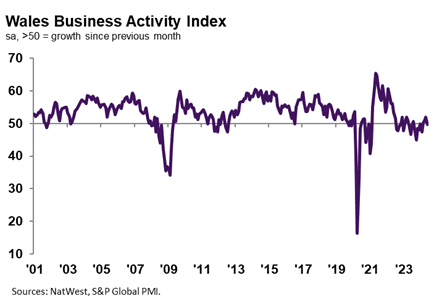

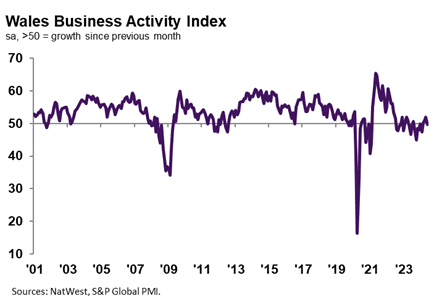

June data signalled a renewed fall in output across the Welsh private sector, according to the NatWest Wales Growth Tracker. The headline Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – posted at 49.7 midway through the year, down from 52.0 in May.

The decline in output was the first in four months, albeit only fractional overall. Panellists reported weak client demand and hesitancy among customers to place orders, as new business fell at a solid pace.

Welsh businesses signalled a return to contraction territory in new orders midway through the year, following a three-month period of expansion. The decrease in new business was solid overall and the quickest since November 2023. Panellists stated that lower new sales were due to weak client demand and a loss of business from existing customers.

June data signalled another steep increase in cost burdens faced by Welsh private sector firms. Alongside higher wage bills, firms noted that greater raw material and transportation prices drove inflation.

Nonetheless, the rate of increase in costs eased for the second month running to the softest since November 2023. Moreover, the pace of inflation was weaker than both the long-run series and UK averages.

Jessica Shipman, Chair, NatWest Cymru Regional Board, said: “Demand conditions weakened in the Welsh private sector midway through 2024, as new business contracted, with a resulting fall in output registered. The drop in activity was only fractional as firms turned to backlogs of work in an effort to boost output.

“Nonetheless, firms continued to take on new staff, with employment rising at the sharpest pace since October 2022. Buoyed by upbeat expectations regarding the year-ahead outlook, job creation was among the steepest of the 12 monitored UK areas.

“Meanwhile, inflationary pressures eased. A below average uptick in cost burdens led firms to moderate hikes in selling prices in a bid to remain competitive and drive new sales.”

Performance in relation to UK

The downturn in business activity contrasted with the UK average which pointed to a modest expansion in output.

Meanwhile, the pace of decline in new orders was among the sharpest of the monitored UK areas, with only the East Midlands and East of England recording faster downturns.

June data indicated further optimism among Welsh companies regarding the outlook for output over the coming year. Confidence was reportedly underpinned by hopes of new client wins, stronger demand conditions and investment in new products.

The level of positive sentiment was greater than both the UK and long-run series averages, despite slipping from May’s recent high.

Welsh private sector firms registered a fourth successive monthly expansion in employment at the end of the second quarter. The increase in workforce numbers quickened slightly from May to the fastest since October 2022. Moreover, of the 12 monitored UK areas, only the South East and North East recorded quicker job creation.

Anecdotal evidence suggested that greater staffing numbers were linked to the hiring of permanent and temporary workers.

As has been the case in each month since May 2022, backlogs of work at Welsh firms contracted during June. The fall in incomplete business was strong overall, despite easing from that seen in May.

The pace of decline was among the sharpest of the monitored UK areas, with only Yorkshire & Humber recording a quicker drop.

Companies attributed the depletion of unfinished business to weak client demand and lower new order inflows.

Welsh businesses registered another monthly increase in output charges at the end of the second quarter. The rate of inflation was solid overall, and in line with the series average. That said, the pace of increase softened to the slowest in nine months and was weaker than the UK trend.

Leave a Reply

View Comments