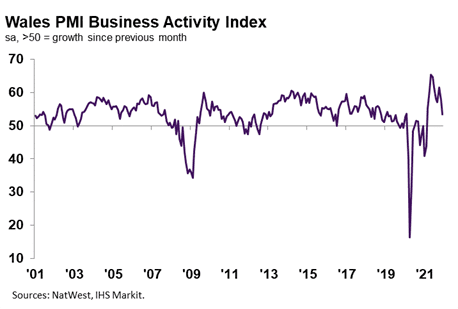

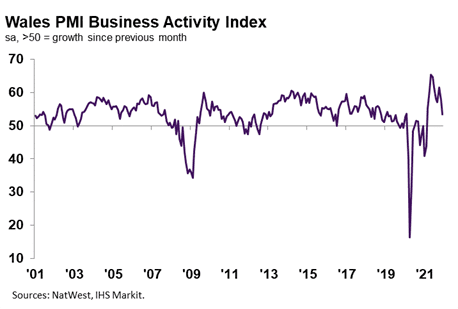

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 53.4 in December, down from 57.6 in November. Although solid, the expansion in business activity was the slowest in the current ten-month sequence of growth. Nonetheless, the rate of increase was broadly in line with the UK average, with firms linking the upturn to sustained client demand.

Private sector firms in Wales registered a solid expansion in new business during December, albeit at the slowest pace in the current ten-month sequence of growth. The rate of increase in new orders was broadly in line with the UK average, which also eased. Although some firms noted that the upturn was linked to sustained client demand, new business growth softened across the manufacturing and service sectors.

Business confidence regarding the outlook for output over the coming 12 months across Wales slipped from November’s series high to among the lowest levels since October 2020 in December. That said, Welsh firms remained broadly upbeat and linked positive sentiment to hopes of an end to COVID-19 restrictions as 2022 progresses and an uptick in client demand. Manufacturers were more optimistic regarding future output than their service sector counterparts.

Welsh private sector firms signalled only a modest expansion in workforce numbers during December, as the rate of job creation slowed for the fourth month running. The rise in employment was the softest since May, and slower than the UK average. Moreover, out of the 12 monitored UK areas, the upturn in Welsh staffing levels was quicker than only the North East. Where firms mentioned difficulties building workforce numbers, this was linked to labour shortages and retention issues.

December data signalled a steep upturn in backlogs of work at Welsh private sector firms. The rate of growth quickened slightly from November’s seven-month low, but was softer than those seen earlier in the year. Alongside material shortages, firms stated that greater work-in-hand stemmed from challenges hiring additional staff. The pace of expansion in outstanding business was the quickest of the 12 monitored UK areas.

Welsh private sector firms indicated a further marked rise in input prices at the end of 2021. The rate of cost inflation eased to a three-month low but was quicker than any other seen before this period. Welsh firms registered one of the fastest upticks in cost burdens of the 12 monitored UK areas, with only Northern Ireland and the East Midlands recording sharper rises. Higher costs were generally attributed to greater transportation charges, increased wage bills and material shortages.

December data signalled a marked rise in output charges across the Welsh private sector. The rate of charge inflation accelerated to reach the fastest since data collection began almost 21 years ago. Of the 12 monitored UK areas, Welsh firms recorded the second-sharpest increase in output prices, slower than only Northern Ireland. Companies largely stated that higher output charges reflected efforts to pass on greater costs to clients.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh firms signalled a slower, but still solid, expansion in output and new orders at the end of 2021. Firms continued to highlight burgeoning backlogs of work, as the rate of growth in outstanding business quickened. Greater work-in-hand stemmed, in part, from material shortages but challenges finding and retaining staff hampered efforts to expand employment and reduce pressure on capacity.

“Rising wage bills, higher material costs and greater transportation and logistics fees all contributed to a marked increase in input prices. Although the rate of cost inflation eased slightly, it remained substantial, with firms registering the fastest rise in output charges as they sought to pass-through higher costs to clients.

“The impact of newly introduced COVID-19 restrictions brought into action following the data collection period are likely to impact client demand over the coming months, however, especially in the more vulnerable service sector.”

Leave a Reply

View Comments