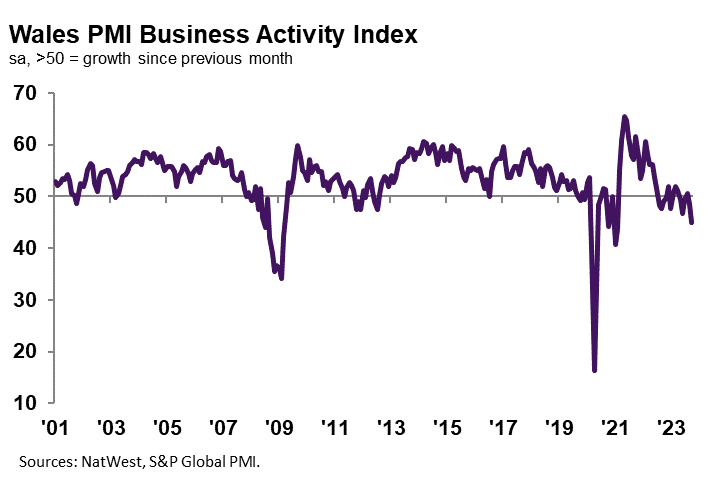

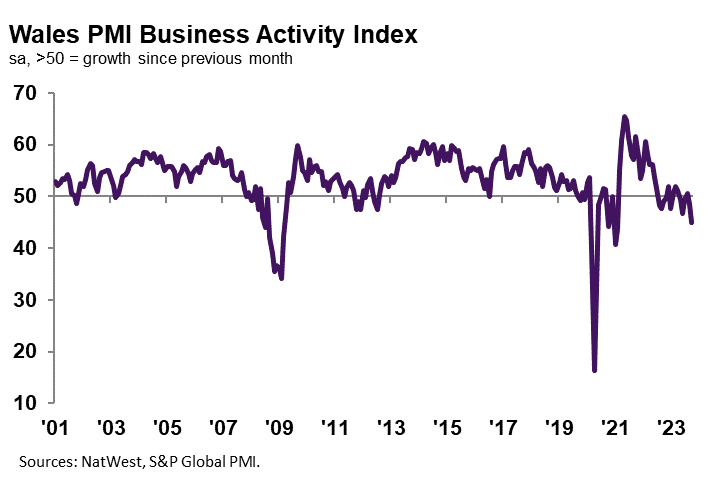

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 45.0 at the start of the fourth quarter, down from 48.4 in September, signalling the strongest downturn in output at Welsh firms since February 2021. The rate of decline accelerated amid reports of worsening demand conditions and a faster fall in new orders. With the exception of the North East, Welsh companies registered the steepest drop in activity of the 12 monitored UK areas.

Welsh private sector firms signalled a marked decline in new business at the start of the fourth quarter. The rate of contraction accelerated notably to the fastest since early 2021. Moreover, of the 12 monitored UK areas, only Yorkshire & Humber recorded a steeper drop in new order inflows.

Weak client demand reportedly drove the downturn amid challenges associated with the cost-of-living crisis and reports of order postponements.

October data signalled stronger optimism regarding the outlook for output over the coming year among Welsh firms. Confidence reportedly stemmed from hopes of investment in capacity expansion and improved demand conditions, especially among customers in Europe. Although the level of positive sentiment picked up, it was below the long-run series average and among the weakest of the 12 monitored UK areas.

Welsh businesses registered a third successive monthly decline in workforce numbers during October. The rate of job shedding was broadly in line with that seen in September and was the second-sharpest of the 12 monitored UK areas, behind the North East.

A slowdown in new orders led firms to not replace voluntary leavers, and in some instances, make workers redundant. Manufacturers and service providers alike cut staffing numbers.

October data indicated a further contraction in outstanding business at Welsh firms, thereby extending the current sequence of decline to a year-and-a-half. The rate of decrease slowed to the weakest since July, but was stronger than the series average. Lower new orders enabled firms to clear backlogs, according to panellists.

Of the 12 monitored UK areas, only Yorkshire & Humber recorded a sharper drop in work-in-hand.

Welsh companies registered another marked rise in input prices during October, with the pace of increase quickening to the fastest for five months. Higher cost burdens were often linked to greater fuel and material prices. At the sector level, manufacturers continued to record lower operating expenses, while service providers signalled a marked rise.

The rate of inflation was slightly slower than the UK average.

Average output charges at Welsh firms rose further in October, with the rate of inflation gathering pace. Companies continued to note the pass-through of higher costs to customers, with the pace of increase slightly sharper than the series trend. Nonetheless, the rate of charge inflation was slower than the average seen across the UK as a whole.

Jessica Shipman, Chair, NatWest Cymru Regional Board, commented:

“It’s encouraging to see that hopes of stronger demand conditions domestically and internationally has spurred business confidence, which picked up from September’s recent low.

“In the here and now, however, Welsh firms continued to signal one of the worst performances of the 12 monitored UK areas, as business activity tumbled following a sharper drop in new orders. Output and new business fell at the steepest rates since early-2021, as the cost-of-living crisis stymied customer spending and order postponements were noted.

“Meanwhile, paces of increase in cost burdens and selling prices gained momentum as greater business expenses were passed through to customers. Firms continued to seek to cut costs, however, as job shedding broadened. Alongside the non-replacement of voluntary leavers, there were some reports of redundancies as new orders dwindled.”

Leave a Reply

View Comments