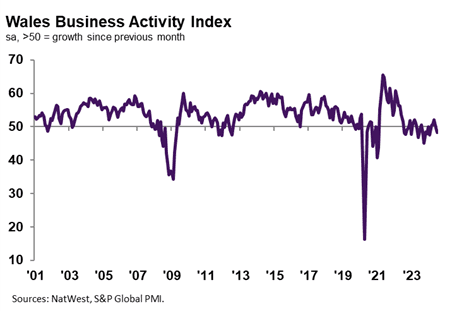

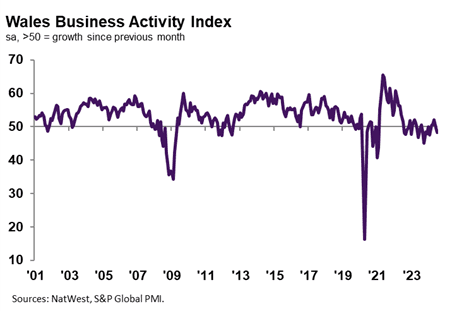

Welsh firms signalled a fall in output at the start of the second half of the year, according to the NatWest Wales Growth Tracker. The headline Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 48.3, down from 49.7 in June to indicate a modest decline in output at Welsh firms. Anecdotal evidence attributed the downturn to previously subdued customer demand.

July data signalled a return to growth of new business at Welsh private sector firms, following a modest decline in June. A pick-up in demand conditions reportedly drove the latest upturn in new orders, albeit only fractional overall.

At the same time, the degree of business confidence at Welsh firms rose to the highest since November 2021 and was notably stronger than the series average. Hopes of greater client demand, further hiring and the launch of new products reportedly underpinned optimism.

Welsh businesses indicated a solid rise in workforce numbers during July, as the pace of job creation quickened to the sharpest since September 2022.

July data signalled a quicker rise in operating expenses at Welsh private sector firms. The rate of cost inflation was broadly in line with the long-run trend, but quickened to the sharpest in three months.

Jessica Shipman, Chair, NatWest Cymru Regional Board, said: “Welsh firms noted challenges but also opportunities as the second half of 2024 began. Output continued to fall, with the rate of decline quickening from June amid previously muted demand conditions. Nonetheless, new business returned to growth, albeit only marginally, and confidence across the private sector improved to the strongest since November 2021. Moreover, firms were buoyed by optimism and raised their staffing numbers at the fastest pace for almost two years.

“Operational costs built, however. Input price inflation accelerated, with companies also raising their output charges at a slightly quicker pace in a bid to ease strain on margins.”

Performance in relation to UK

For a second month running, the downturn in output at Welsh firms contrasted with a solid expansion in activity across the UK as a whole.

Of the 12 monitored UK areas, 11 recorded growth in new orders during July, with the exception of the East Midlands. Welsh firms, however, registered a much slower rise in new sales than the UK average.

Business optimism regarding the outlook for output at Welsh firms was among the strongest of the 12 monitored UK areas, and above the UK average.

Moreover, the pace of employment growth was among the steepest of the 12 monitored UK areas. Panellists stated that greater staffing numbers were due to optimism in the outlook and increased new order inflows.

The rise in staffing levels helped firms to clear backlogs of work in July, as incomplete business fell to the greatest extent in 2024 so far. The rate of contraction was the quickest across the UK areas monitored by the survey and was sharper than its long-run series average.

On the price front, the pace of increase in input prices was also slightly faster than the UK average, as firms linked higher input prices to increased costs for shipping, foodstuffs and raw materials.

The rate of selling price inflation was little-changed from that seen in June, but solid overall. Higher output charges were attributed to the pass-through of greater costs to customers. In contrast to the trend seen for input prices, the pace of charge inflation was among the slowest of the 12 monitored UK areas – faster than only the East Midlands, Scotland and Northern Ireland.

Leave a Reply

View Comments