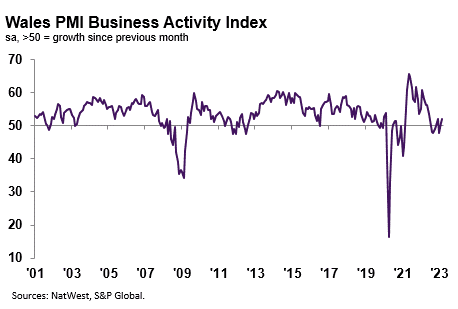

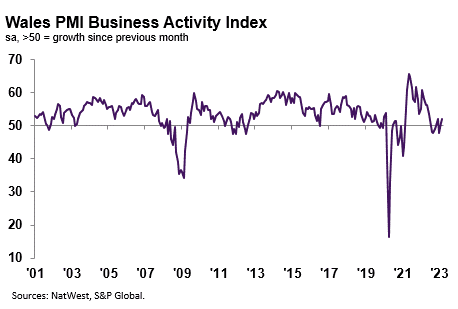

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 51.1 in April, down slightly from 52.0 in March, to signal a marginal expansion in output at Welsh private sector firms. Where an increase in activity was noted, companies stated this was due to a further increase in new orders. The rise in business activity was the third in as many months, but was the slowest of the 12 monitored UK areas.

Welsh private sector firms recorded a second successive monthly expansion in new orders in April. Greater new business inflows were linked to higher demand and increased customer activity. That said, the rate of growth slowed from March’s 10-month high to only a modest pace. The rate of increase was also weaker than the UK average.

April data signalled stronger expectations among Welsh firms regarding the outlook for output over the coming 12 months. Optimism reportedly stemmed from planned investment in marketing and sales initiatives, hopes for future upticks in client demand and new product launches. The degree of confidence picked up to the strongest since November 2021 and was greater than the UK trend level.

Manufacturers and service providers registered more upbeat expectations for the coming year, with the former the most confident of an increase in output.

Welsh private sector firms recorded a fourth consecutive monthly decline in employment at the start of the second quarter. The decrease in workforce numbers was marginal overall, and eased to the slowest in the aforementioned sequence of contraction. Nonetheless, job shedding was attributed to the non-replacement of voluntary leavers amid cost-cutting efforts.

Wales was the only monitored area to register lower employment, with the UK average signalling a solid upturn in staffing numbers.

April data indicated a further drop in the level of outstanding business at Welsh private sector firms. The decrease was steep overall, and quickened to the fastest since July 2020. The fall in incomplete business was linked to sufficient capacity to work through new orders in a timely manner.

The decline in backlogs of work contrasted with the UK average which signalled unchanged levels of unfinished business. Welsh businesses registered the sharpest decrease of the 12 monitored UK areas.

Welsh firms noted another substantial monthly increase in input costs during April. Cost burdens rose following greater material and labour expenses, as wage bills reportedly drove inflation. The rate of increase picked up after easing for six successive months and was broadly in line with the UK average. Nonetheless, the pace of inflation was the second-slowest since February 2021.

Average prices charged by Welsh private sector firms increased again in April, with the rate of inflation accelerating for the first time since January. The pace of increase was the quickest for three months despite being among the slowest in the last two years. Companies commonly noted that the pass through of higher costs to clients drove up charges.

Welsh firms recorded the fastest rise in output charges of the 12 monitored UK areas.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh firms signalled a drop off in growth momentum during April, as expansions in output and new orders softened. Companies were challenged further as inflationary pressures regathered speed, with selling prices rising at the fastest rate for three months. Hikes in supplier and end-customer prices are likely to exacerbate obstacles to growth as client spending may be squeezed further.

“Meanwhile, jobs continued to be cut as voluntary leavers were not replaced in an effort to reduce outgoings amid reports of strong hikes in wages. Firms appeared to absorb the fall in employment with little knock-on impact on capacity, as backlogs dropped again, and at a faster pace. Nevertheless, companies were strongly upbeat in their expectations for the coming year. Optimism improved to the greatest level since late-2021.”

Leave a Reply

View Comments