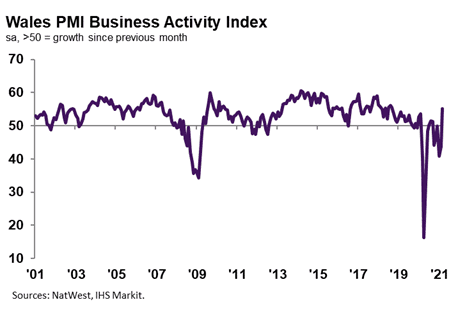

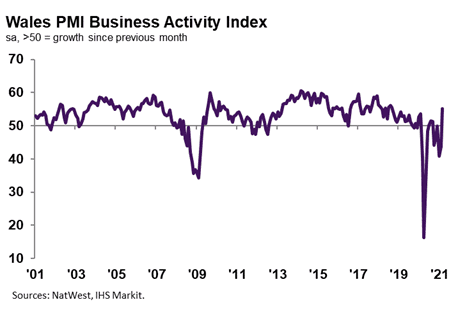

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 55.1 in March, up notably from 43.7 in February, to signal a renewed rise in business activity across the Welsh private sector. The upturn was widely linked to greater client demand and an increase in new orders following hopes of an end to lockdown restrictions as 2021 progresses. The rate of output growth was the fastest seen across Wales since September 2018 but was slightly slower than the average for the UK as a whole.

Private sector firms operating in Wales registered a renewed expansion in new orders during March, thereby bringing to an end a two-month sequence of contraction. Moreover, the pace of new business growth was strong overall and the sharpest since August 2018. Companies often stated that greater new sales stemmed from stronger domestic and foreign client demand, with some also noting an uptick in spending amid hopes of an end to COVID-19 restrictions.

The rate of increase in new orders was slower than the UK average, however.

March data signalled the strongest degree of business confidence across the Welsh private sector since data collection for the series began in July 2012. Marked optimism was reportedly linked to hopes of an end to the COVID-19 pandemic and social distancing restrictions. An improvement in positive sentiment at Welsh firms reflected greater confidence at businesses across the UK as a whole.

Welsh companies indicated another monthly decline in workforce numbers at the end of the first quarter, thereby extending the sequence that began in March 2020. The fall in employment contrasted with the UK trend where renewed growth was registered. The latest decrease in staffing numbers was attributed to ongoing efforts to cut costs.

Welsh firms registered a renewed increase in backlogs of work during March. Although only marginal, the rate of growth was the sharpest for two years. Outstanding business was commonly linked to supply chain disruption and delivery delays for key inputs. The pace of accumulation was slightly slower than the UK average.

Private sector firms across Wales noted another monthly increase in cost burdens during March. The rise in input prices was widely linked to higher costs for key inputs such as fuel and electronics, and greater shipping fees. The rate of inflation quickened to the steepest since January 2017 and was among the fastest of the 12 monitored UK areas.

The rate of increase in selling prices accelerated for the second month running to the sharpest since April 2018 at the end of the first quarter. The rise in charges was reportedly due to efforts to pass on higher costs to clients. Meanwhile, the pace of inflation was slightly faster in Wales compared to the UK as a whole.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh firms registered a notable turnaround in activity and client demand during March, as restrictions begin to ease across the country. New orders rose at the steepest rate since August 2018, with hopes of an end to COVID-19 measures as 2021 progresses leading to the strongest degree of optimism among private sector firms on record (since July 2012).

“Meanwhile, marked cost pressures remained apparent, with input prices increasing at the sharpest pace since early 2017. Encouragingly, output charges rose at a faster pace, as stronger client demand allowed firms to pass on a greater proportion of the increase in costs to clients.”

Leave a Reply

View Comments